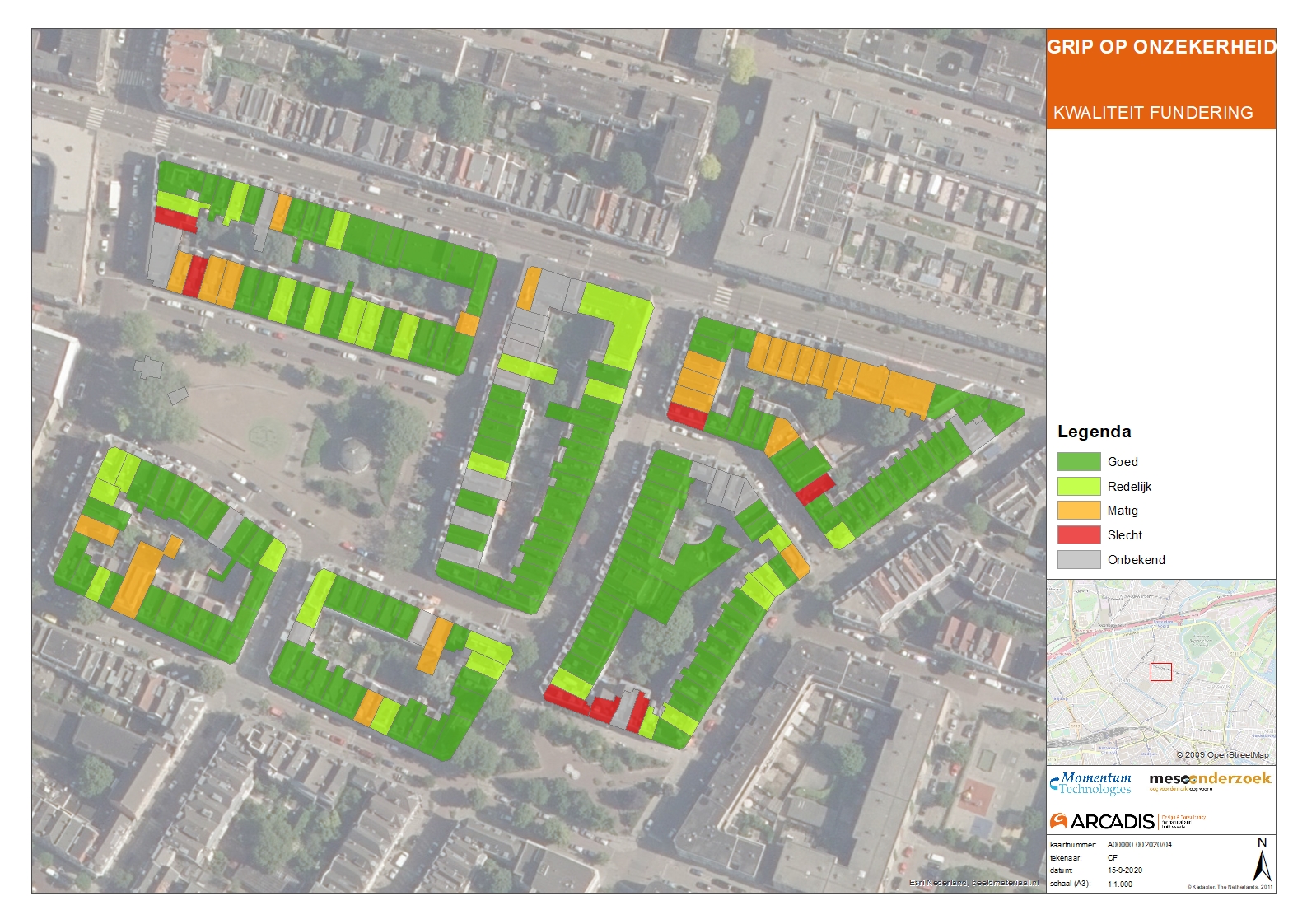

Any investment in real estate is uncertain. The current value cannot be determined with certainty. The same is true of the value after improvements to real estate. There are costs associated with improvements and the question is do the returns outweigh them? Point estimates of value can easily give too positive or too negative a picture. By generating a probability distribution for each estimated value, the risk of disappointing returns can be taken into account when deciding on that investment. This is illustrated below using a concrete example of foundation problems. The area at risk is a 19th century neighborhood in the center of Rotterdam: Het Oude Noorden. The choice is between eliminating the risk by means of a structural improvement of the foundation of the present house or demolish the old one and built a new at the some lot. Some 1 million houses is at risk and the owner is confronted with a smaller or a bigger problem, he might not be able to solve himself.

“Woon Amsterdam”

“Woon Amsterdam” annual report on the housing market since 2006

Woon Amsterdam” has been published every November since 2006. It offers an overall picture of the state and development of the Amsterdam housing market. The report is the result of cooperation between the Amsterdam Real Estate Association (MVA), the Amsterdam Federation of Housing Corporations and the City of Amsterdam. Since 2010, the report is also available online at the MVA site.

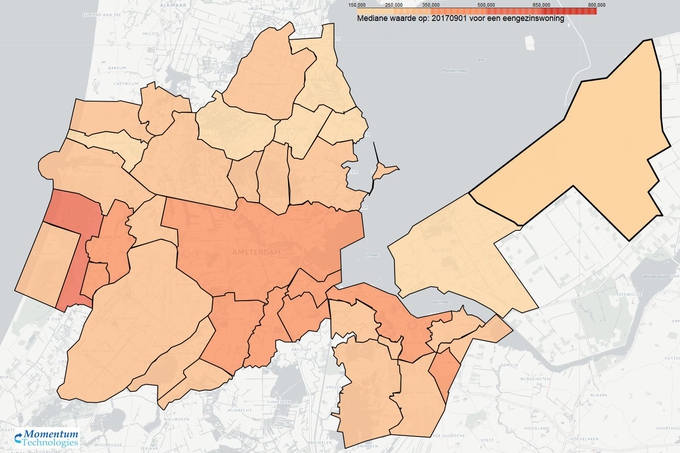

In 2017, in addition to the market figures for the City, figures became available for the entire Amsterdam Metropolitan Region. Furthermore, from that year, figures are available on the level and development of market values in the metropolitan municipalities, the City of Amsterdam and the city districts. Momentum Technologies, in close cooperation with the MVA, provides figures on the supply, sales and market values of homes for sale throughout the Amsterdam Metropolitan Area.

Homelocator

For a better understanding of housing opportunities within the Metropolitan Area, an application was created in 2019 that allows every house seeker to determine, from one or more locations (workplace, school address, etc), an associated mode of transportation (bicycle, public transportation, car) and a maximum travel time, the area where the house might be located. The application then provides a picture of the market values for the parts of this area for a housing type of choice. The user can further narrow down the area by limiting the price range. For each area of interest, the user can zoom in and will then also see the houses for sale. Detailed information for each property is then avalaible.

Key figures 2019:Woon

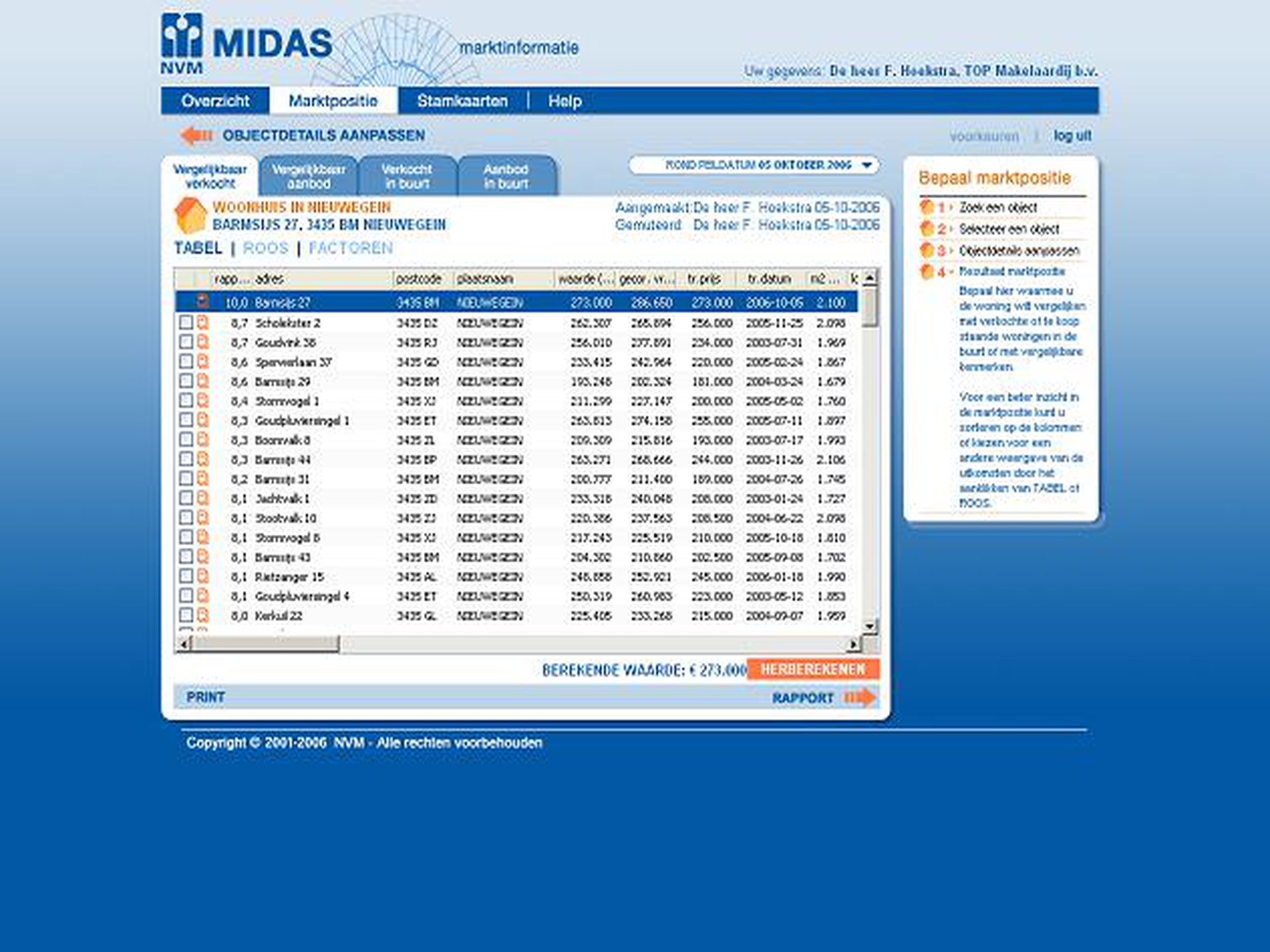

“Wonen MarktPositie”

- determining a good asking price for a home for sale,

- advising on a reasonable price when purchasing a home or

- appraising for a mortgage lender or in case when children inherit their parents’ house, for example,

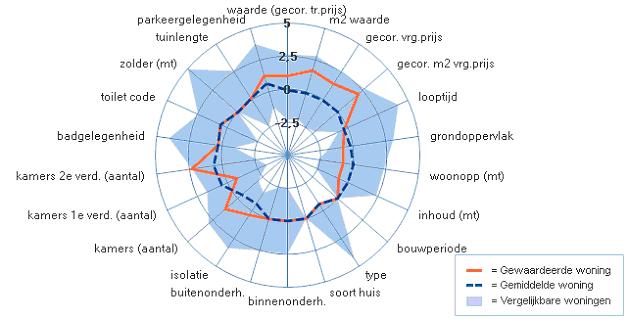

”MarktPositie”: the rose, the characteristics of the property to be valued relative to the average home and the full set of comparable homes

NAM Groningen depreciation scheme

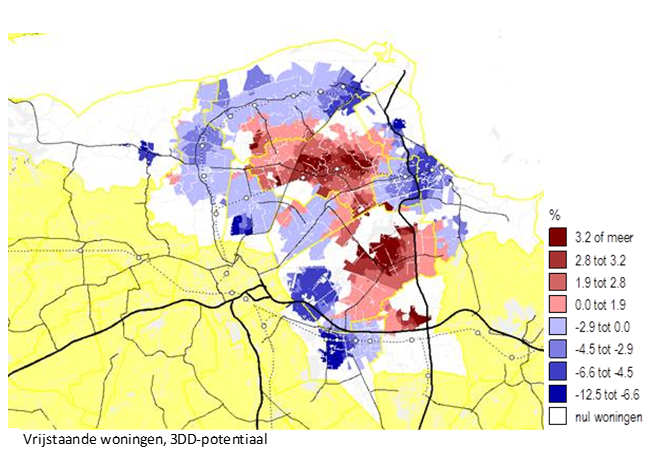

On Aug. 16, 2012, an earthquake measuring 3.6 on the Richter scale occurred near Huizinge in the province of Groningen in the Northeast of the Netherlands. On Jan. 25, 2013, the Royal Netherlands Meteorological Institute (KNMI) presented new research in response: Groningen had to reckon with future earthquakes up to a magnitude of 5 on the Richter scale. It is generally believed that house prices in the earthquake area have been under pressure ever since. Compensation for material damage to homes by NAM (the company responsible for the production) had already long been in place. However, for the (after damage repair) remaining decrease in value, this was not the case. This is why the so-called “Regeling Waardedaling” (or Depreciation Scheme) was estbalished. The Scheme applies to homes located in the risk area (11 municipalities) who were sold since January 25, 2013.

For NAM, Momentum Technologies devised and elaborated the method for determining whether and to what extent there is a negative effect of the earthquake risk in the case of the sale of a home. From the beginning, Momentum Technologies has been responsible for the automated determination of the development of the value of the home in the earthquake area, at 100 reference locations and the delta W derived from it. The delta W measures the difference in value development between the earthquake area and the reference locations. When the development of the market value in the earthquake area lags behind that in the reference locations, the seller is eligible for compensation. To determine the compensation in the Depreciation Scheme Momentum Technology has been cooperating with Arcadis (direction), Atlas for Municipalities (selection of reference locations) and local real estate agents/appraisers (recording house characteristics, test sales process, final assessment and appraisal report). In the earthquake area, detached houses are not the exception but the rule. They can differ greatly in characteristics and are not easy to value.

The purpose of the Depreciation Scheme is to fairly compensate sellers for the financial disadvantage of the lagging value development due to earthquakes and earthquake risk. The task is to determine and compensate teh disadvantage as precisely as possible, without thereby disrupting the housing market in an already vulnerable area.

The Depreciation Scheme tries to isolate the effect of earthquakes and earthquake risks on the development of the value of dwellings as good as possible from the other elements that can influence price developments in the housing market. This is done using the so-called abc formula. The value development of a home sold in the risk area is compared with the value development as it would have been if (a) the same home had been in (b) a similar area but (c) without earthquakes.

The database of the Dutch Association of Real Estate Agents and Valuers (NVM), and more specifically “Wonen MarktPositie”, the valuation system used by NVM members, is used to determine the value development of the homes. This system searches for each property to be valued, based on a large number of housing characteristics within the NVM database, for the most comparable homes sold in the neighborhood. On this basis, first the (development of the) market value of the sold house in the risk area is determined (the a of the abc formula).

Next, the value development of the sold house is compared to the value development that the same house would have experienced on a location in a comparable place in the Netherlands without earthquakes. For this purpose, the house is valued again, now at one hundred reference locations in the country that are as similar as possible to the actual location (the b of the abc formula), except for earthquakes and earthquake risk (the c of the abc formula). Those sites are selected based on a wide range of site characteristics. This ensures as good as possible that the reference sites are otherwise well comparable, and minimizes the chance that factors other than earthquakes and earthquake risk affect the difference in the debelopment of the market value.

The difference between the value development of the home sold in the risk area determined in this way and the reference sites (the average of the seventy best reference locations) is the relative decline in value. The assumption is that this relative decline in value is due to earthquakes and earthquake hazards.

An appraiser assesses the model-based decline in value for plausibility. If necessary, he has additional market information at his disposal and information about possible earthquake-related damage. In most cases, he will adopt the model-based decline in value. If the appraiser believes that the model outcome is not plausible, he adjusts it. In addition, the appraiser has the option to award additional compensation in exceptional cases; for example, in the case of earthquake damage to the home that has been repaired but is still clearly visible.

In practice, the Depreciation Scheme shows to work well. Figures on applications and compensation can be found on the NAM site. More than 95% of applicants immediately accept the amount of compensation offered. This figure is an important indication that the goal of the Depreciation Scheme – fair compensation for people who have experienced a relative decrease in the value of their homes due to earthquakes – is being achieved with the current scheme. Of course, this does not alter the fact that the scheme is under constant critical scrutiny, and where necessary is further improved.

Eindhoven TU

For several years , we have been successfully advising and supporting the Eindhoven University of Technology (TU/e) in its contact with the Municipality of Eindhoven when it comes to correctly determining the WOZ (property tax) value of its real estate.

The TU/e owns about 40 buildings, each of which needs to be valued using the Replacement Value method (GVW method). The starting point of this appraisal method is the gross replacement value of a basically identical object/building, based on current construction costs and construction methods. This gross replacement value is then technically depreciated to account for the impact of the difference between value year and year of construction, and functionally depreciated to correct for functional obsolescence since construction.

GVW method

A GVW is created by depreciating the gross replacement value technically and functionally.

Together with ARCADIS’ cost experts, we calculated the gross replacement values of all buildings. The GASP system (Building Analysis System Projects) was used for this purpose. The purpose of the GASP system is to determine the average form factors and cost factors per building and to function as a standard post-calculation program. GASP has proven itself in practice for years as ARCADIS cost experts use it to calculate the construction costs of new buildings and apply it on behalf of numerous parties. After each completed project, the actual construction costs and associated (object) characteristics are added to the database.

ARCADIS’ cost experts have determined the form factors (this summarizes the construction of a building) for each of the objects to be valued. In addition, the cost experts determined the materials used and the finishing for each object to be valued. This ensures that the calculated gross replacement value of an object to be valued belongs to the object to be valued. By using the data kept up-to-date in GASP, the cost experts based the calculated gross replacement values on the construction costs and the construction methods at the date of the valuation.

The technical obsolescence correction is determined by linear depreciation over the service life. Here the variables lifetime, remaining lifetime and residual value determine the final outcome. The residual value represents the amount that the property is worth at the end of its use.

Functional aging involves four components:

- Change in construction method

- Economic obsolescence

- Limited use

- Excessive operating costs

Change in construction method:

This occurs when the construction cost of the original construction method of the part is higher than the current construction method. To assess whether the original construction cost of a property is higher or lower than the current construction cost, we compared the indexed historical construction cost with our calculated, current construction cost. After all, indexing the historical construction costs expresses the construction costs incurred then in today’s euros, and the calculated construction costs reflect the expected construction costs to build the same building in today’s euros.

Economic obsolescence:

TU/e vacancy rates were used for this purpose.

Limited use:

The gross replacement value is based on construction costs of comparable, recent construction projects. This means that the gross replacement values incorporate innovations in terms of efficient use of surface area. In other words, the return per m2 of surface area at the time of the valuation date is higher than the return per m2 of surface area at the time of construction. In order to arrive at the value of the object to be valued, which has a lower return per m2 than the notional object associated with the gross replacement value, a correction must be made for this.

Limited use includes the obstruction of the organization’s normal activities by an inefficient arrangement of space. Examples include:

- Outdated or poor architecture, ceilings that are too low or too high, incorrectly situated rooms and useless spaces, too little daylight;

- The no longer optimally functioning layout of the rooms of use, this in connection with changed insights and developments;

- Inadequate facilities: poor construction workmanship, abnormal detailing and poor installations;

- An excess of facilities: an overkill of technical facilities or too large an area, overly luxurious construction;

- Legal provisions: Working conditions act or environmental laws.

To determine the corrective for the limitations in use during the viewing attention was payed to:

- The horizontal traffic area in relation to the useful area;

- The voids;

- The floor height;

- The entresols;

- Installation area in relation to useful area.

Next, these data of the objects to be valued were compared with what can be expected with new construction. This analysis shows that, at the time of the value date, one deals so efficiently with layouts of use areas that a deduction is appropriate.

Excessive operating costs:

Functional obsolescence due to excessive utility costs indicates the extent to which the building being valued, in terms of utility costs, is not functioning optimally. This correction indicates to what extent a building is worth less because, for example, the insulation is not optimal.

To determine the correction for excessive utility costs, ARCADIS looked at the way facades and roofs were insulated, among other things. Furthermore, the accessibility of the elements to be maintained was examined. By comparing the energy and maintenance costs of the object to be valued with the energy and maintenance costs of the reference objects from GASP, the extent to which the object to be valued does not function optimally in terms of user costs was determined.

Tiox

An appraisal guide is a document that municipalities and appraisal agencies use as a reference when performing an appraisal and contains a description of the appraisal methodology to be used, the key figures and the supporting market data. TIOX is the Internet version of the appraisal manuals and guides the appraiser in an automated manner when valuing an incourant object, which stimulates national uniformity.

Taxation Guide | Valuation methodology | Available in TIOX |

|---|---|---|

Bus stations | GVW method | Yes |

Crematory | GVW method | Yes |

Culture | GVW method | Yes |

Defense | GVW method | Yes |

Healthcare | GVW method | Yes |

Infrastructure | GVW method | Yes |

Children’s farms | GVW method | Yes |

Monasteries | GVW method | Yes |

Laboratories | GVW method | Yes |

Dutch Railways | GVW method | Yes |

Utilities | GVW method | Yes |

Education | GVW method | Yes |

Government buildings | GVW method | Yes |

Parking | GVW method | Yes |

Sports | GVW method | Yes |

Telephony | GVW method | Yes |

Care | GVW method | Yes |

Wind Turbines | GVW method | Yes |

Motor Fuel Sales Points (MBVP’s) | Real Estate Standard Method | Yes |

NWS estates | See appraisal guide | Yes |

Recreation | DiscountedCashflow method | Not yet |

Residential trailers | Comparison method | Yes |

Agricultural buildings | Comparison method | Yes |

Agricultural land | Comparison method | Yes |

Ports and Industry | See appraisal guide | No |

GVW = Corrected Replacement Value

Furthermore, TIOX offers the ability to value obsolete properties that cannot be directly linked to existing valuation guides by means of a “dummy”.

TIOX, can be used:

- Through the web application.

- Through an external system and the web service. In this process, the external system operates like the Web application and asks TIOX to perform operations. The communication is through the web service. It is synchronous processing and further processing takes place in the external system.

- By calling the web service directly. By sending a message to TIOX, some data can be retrieved, such as the key figures and archetypes or the valuation guide itself. Further processing is the responsibility of the external system.

- Via asynchronous processing. TIOX offers the ability to submit WOZ objects in bulk for valuation.

- By modifying stored appraisals. The web application is always available to modify an appraisal. The data is then stored in TIOX. It is possible to retrieve appraisals from a specific date.

An example of processing may be as follows:

- External system offers in bulk a number of WOZ objects.

- TIOX checks the data, sends error messages and performs an assessment for all correctly entered WOZ properties.

- In the external system or through the web application, the data are corrected.

- If the data in the web application has been corrected, the external system may request that all appraisals performed as of a certain date be sent to the external system.

- The external system handles further valuation.

TIOX is basically a calculator that guides the appraiser during the valuation of a WOZ property in accordance with the valuation guidelines. Hereby TIOX offers the possibility to make a complete valuation report. TIOX is not intended to keep municipal records. Data such as cadastral data are not stored in the database. However, the appraiser has the possibility to enter the cadastral data of a property to be appraised so that TIOX can generate a complete appraisal report.

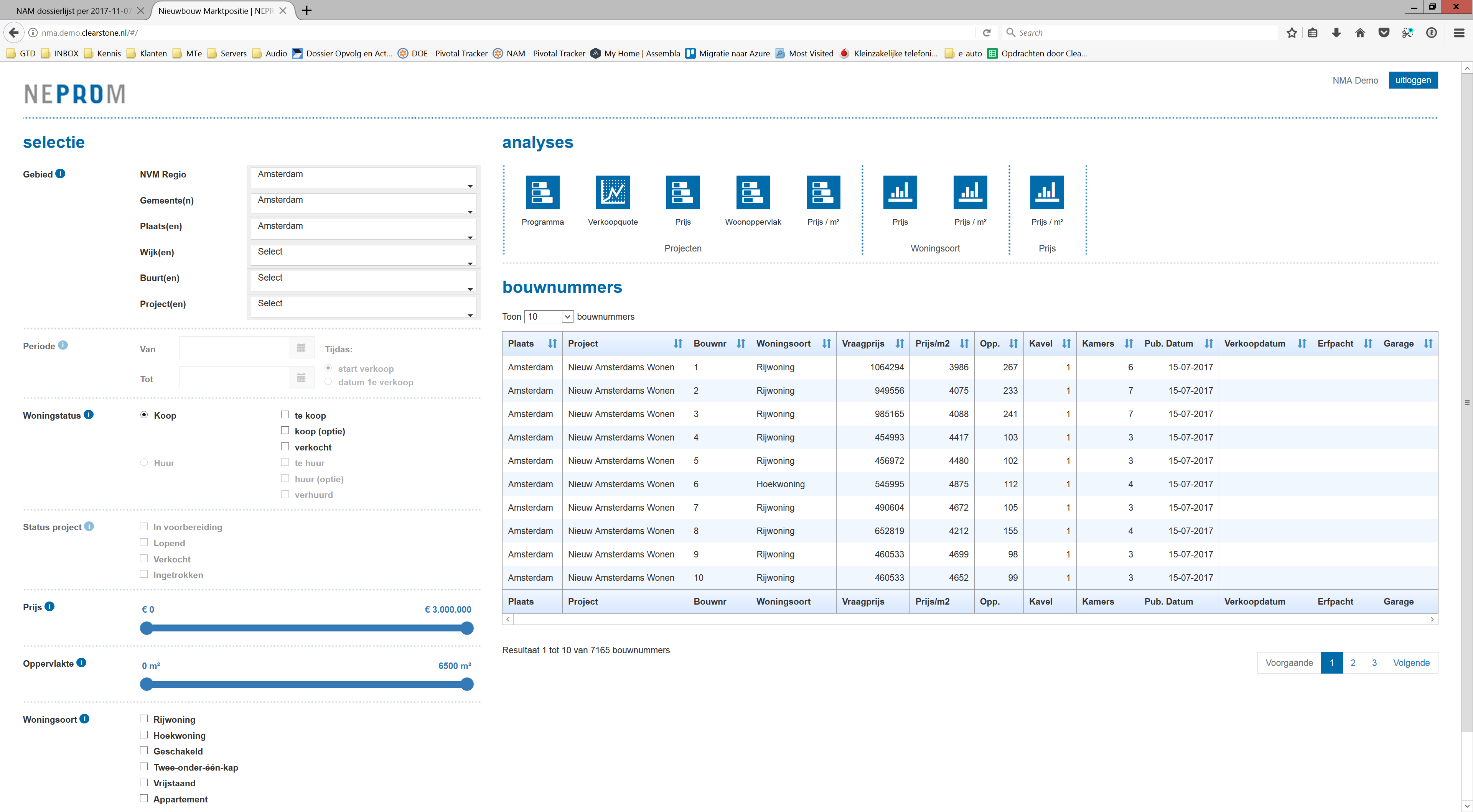

“Nieuwbouw Marktanalyse”

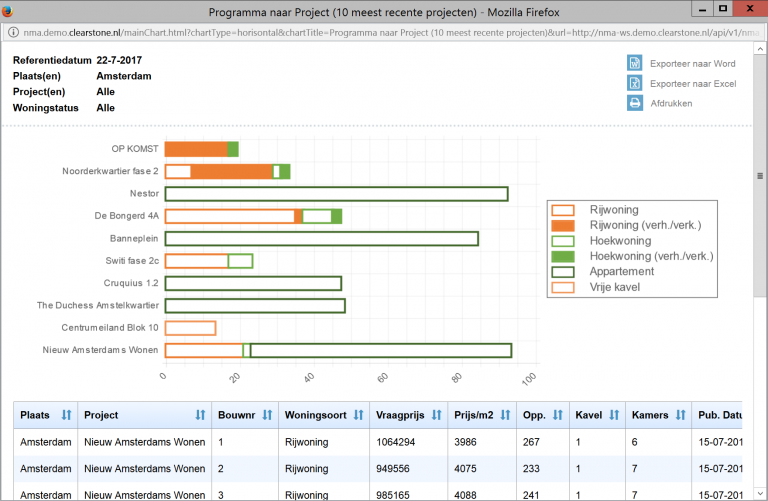

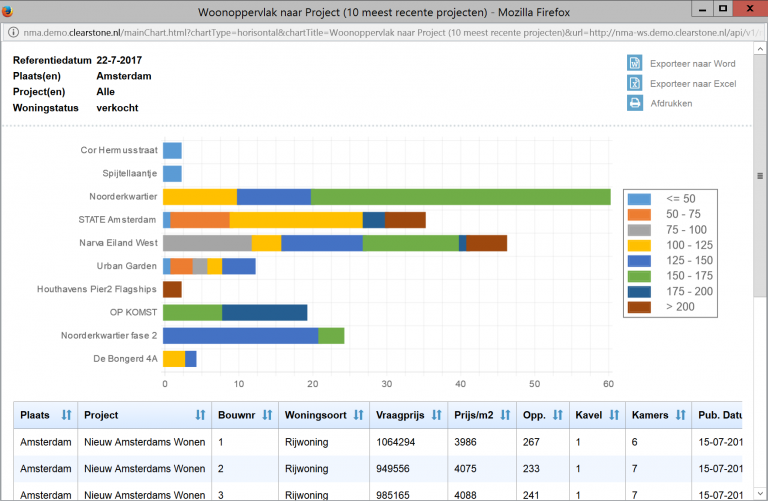

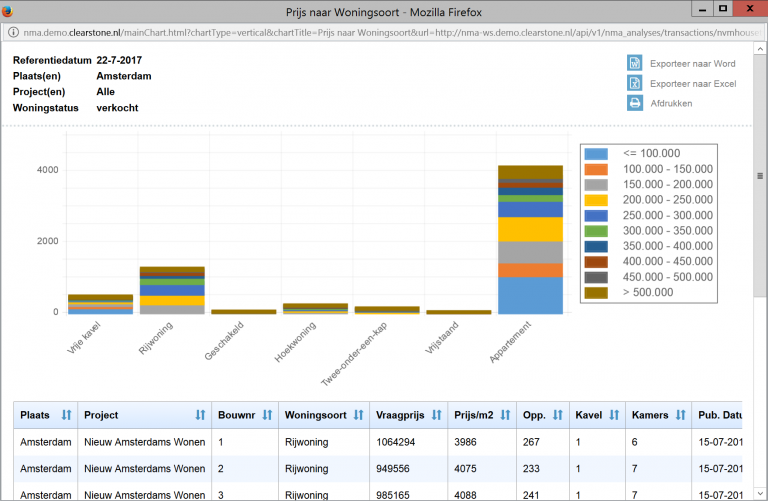

For the NEPROM (Dutch Association of Project Developers_) and the LNP (The national site for newly built houses), we created a system for analyzing the market for newly built houses in the Netherlands.This system enables their members to get a better picture of this market. It gives project developers better insight into answers to the question, “in what place is there a need for what kind of new housing?”.

If the system is zoomed in to a particular location, all the existing projects of new houses, or projects still under development, come into view. All kinds of market figures are available, such as the composition of the project(s) in terms of numbers, housing housing and price levels.

Members of NEPROM and subscribers to the “Landelijk Nieuwbouwplatform” have access to the system by analyse.hetnieuwbouwplatform.nl.

Leasehold Amsterdam

Time to come clean!

Our company specializes in the model-based valuation of real estate. In cooperation with appraisers, we value residential, commercial and obsolete real estate (e.g. schools and universities). Thus, we have knowledge of different valuation methods.

One of our colleagues lives in Amsterdam and recently received an offer from the municipality to buy out his leasehold contract. He was shocked by the redemption price.

The difference in land value and the redemption price of the leasehold contract is considerable. For our colleague, the redemption price (112,298 euros) is more than 2x the land value determined by the municipality (52,440 euros). This seems unfair to us. Our colleague would pay 59,858 euros too much while in recent years, even without taking into account a discount rate, he has already paid about 30,000 euros in canon.

We have asked the political parties in Amsterdam how they see things.

From the responses and our own research on the impact of ground leases on sales prices, we conclude:

- The very existence of the ground lease system is questionable.

- In fact, partly due to lack of knowledge, buyers do not take into account leasehold contracts when assessing the reasonableness of the asking price, so they do not pay significantly less for a leasehold property than for a home on their own land.

- Buyers (of non-new homes) therefore pay the land value twice.

To begin with, they pay the land value to the seller; in addition, they take over the ground lease contract and pay the municipalground rent on the land.

- The land value and canons determined by the City of Amsterdam were set too high.

- The land value is determined by subtracting the building value from the WOZ value.

The building value is determined by amortizing the cost of new construction based on technical and functional obsolescence that has occurred since the year of construction.

The municipality does not take into account, however, that the value of the superficies, like any other asset, is partly determined by supply/demand relationships.

Especially in Amsterdam, where (residential) building land is a scarce commodity, the value of the building land can be higher than the new construction price.

The superficies value is underestimated by the municipality, resulting in the land value and related canon being set too high.

Given the financial interests of residents and municipality, further substantive discussion of the purpose and design of the current redemption scheme is not only necessary but urgent.

In its current setup, the ground lease and surrender scheme do not contribute to the proper functioning of the housing market. However, the excessive redemption fees make it impossible for many residents to buy out the leasehold, leaving the municipality with a leasehold scheme it wants to get rid of for several reasons.

Contact us