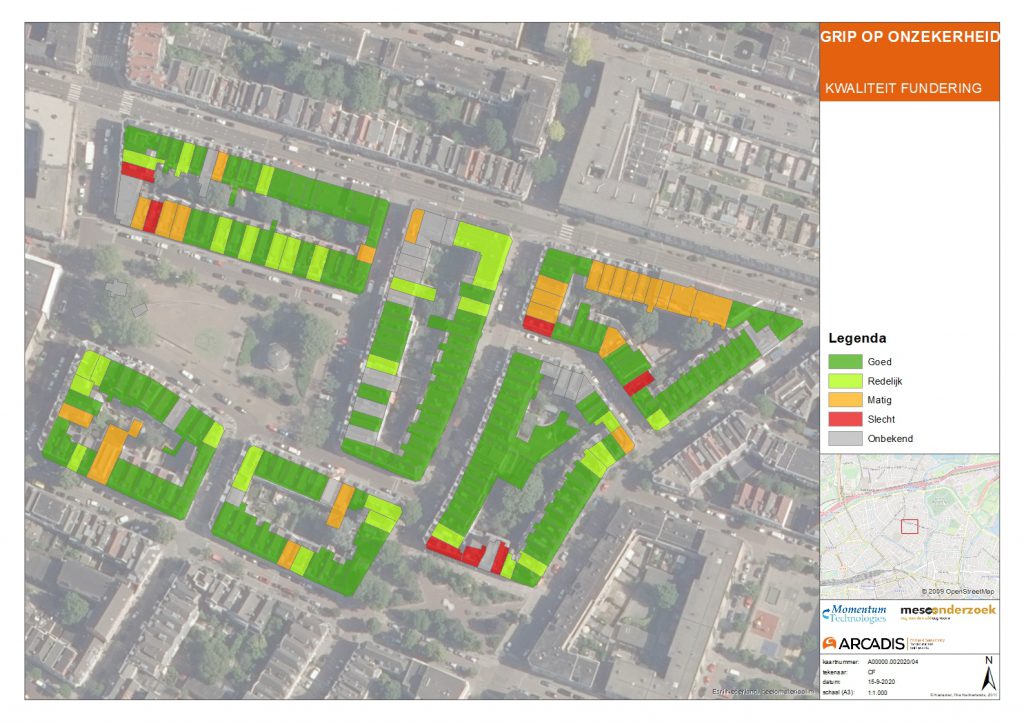

Any investment in real estate is uncertain. The current value cannot be determined with certainty. The same is true of the value after improvements to real estate. There are costs associated with improvements and the question is do the returns outweigh them? Point estimates of value can easily give too positive or too negative a picture. By generating a probability distribution for each estimated value, the risk of disappointing returns can be taken into account when deciding on that investment. This is illustrated below using a concrete example of foundation problems. The area at risk is a 19th century neighborhood in the center of Rotterdam: Het Oude Noorden. The choice is between eliminating the risk by means of a structural improvement of the foundation of the present house or demolish the old one and built a new at the some lot. Some 1 million houses is at risk and the owner is confronted with a smaller or a bigger problem, he might not be able to solve himself.